December 2020

Enterprise Technology Partner Ecosystems: E-commerce

How are vendors approaching e-commerce?

The impact of COVID-19 on consumer behavior is undeniable, and consumers’ digital experience is more important now than ever. In the context of digital experience, the concept of omnichannel results in a single, seamless interaction with consumers across all channels, both online and offline. This can include all touchpoints such as — websites, social media, live chats, follow-up emails, phone calls, and in-person assistance within storefronts.

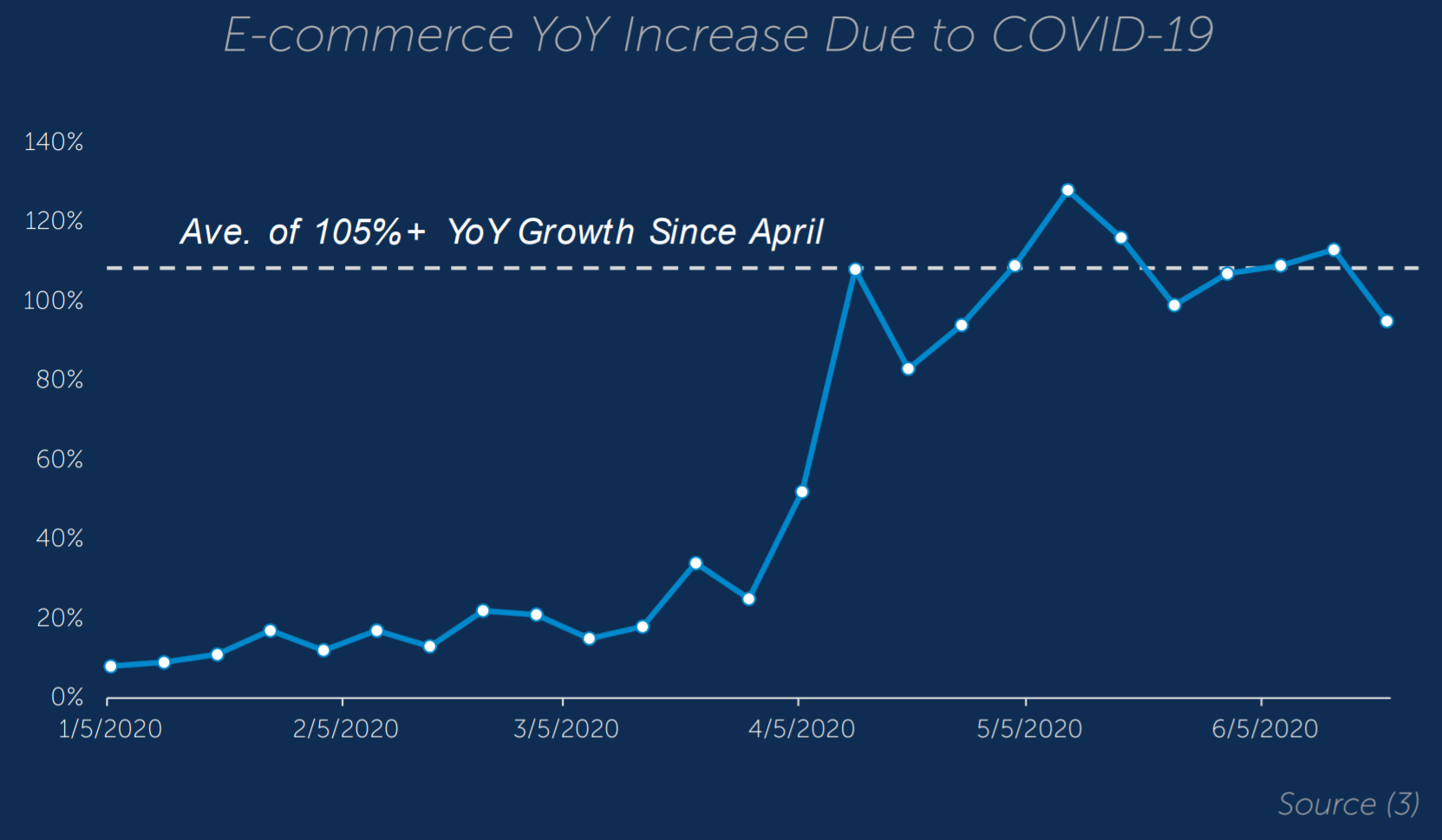

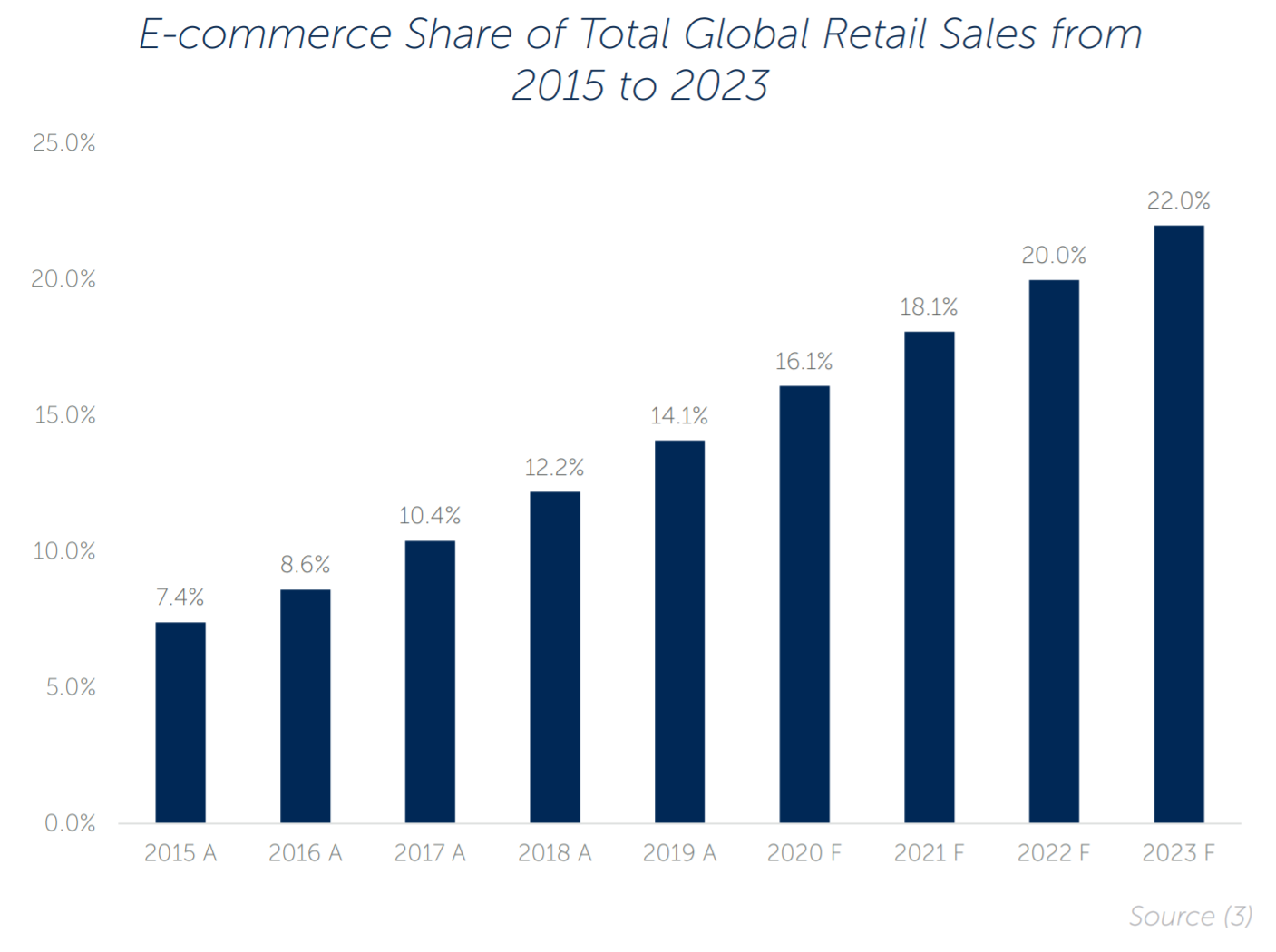

COVID-19 has accelerated the need for organizations to implement innovative strategies for digital commerce. The pandemic has caused the market to experience rapid growth of 105% YoY, and e-commerce sales have doubled as a percentage of global retail sales since 2015. These changes are here to stay, with 70% of Americans believing that COVID-19 will have a lasting impression on their personal routines. Other factors driving digital commerce growth are the number of global mobile internet connections continuing to grow significantly, low technical barriers to entry, and faster internet speeds.

This report overviews the E-commerce industry, the top platforms available, and recent M&A transactions in the space.

Market Overview

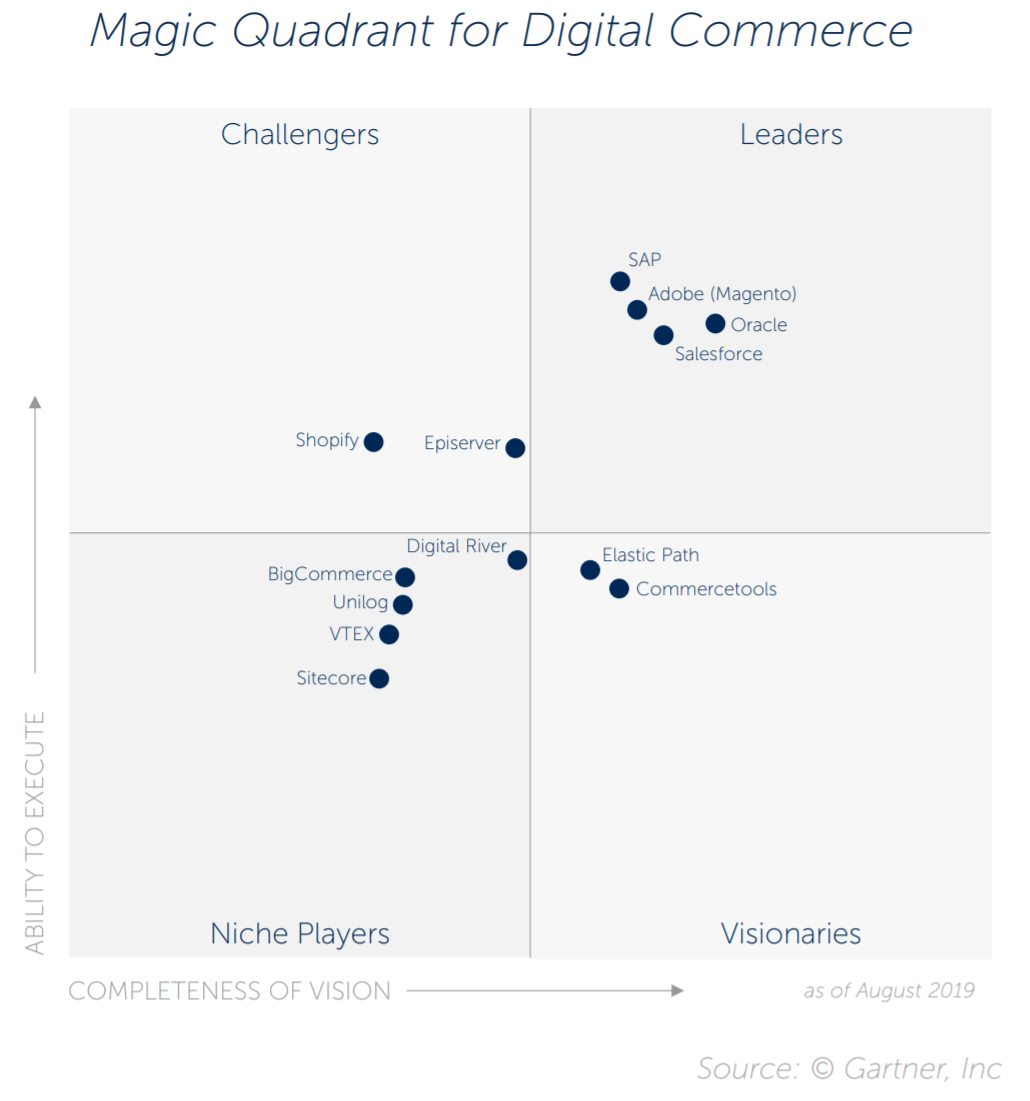

The E-commerce ecosystem is continuing to see accelerated growth in the COVID-19 environment. According to Salesforce, e-commerce activity increased by 71% in the second quarter of 2020 (1). The question many are asking is, “will the tailwinds from COVID-19 continue to increase the adoption rate, and prevalence of, e-commerce, or will the growth and adoption rates begin to flatten as brick and mortar options open back up?” Gartner clearly outlines the leading platforms in e-commerce (SAP Hybris, Adobe Magento, Salesforce Commerce Cloud, and Oracle Commerce Cloud), but it’s important to note the rising stars and platforms of choice for merchants serving the SMB market through Enterprise. This report will explore these ideas and others.

COVID-19 Impact on E-commerce and Market Tailwinds

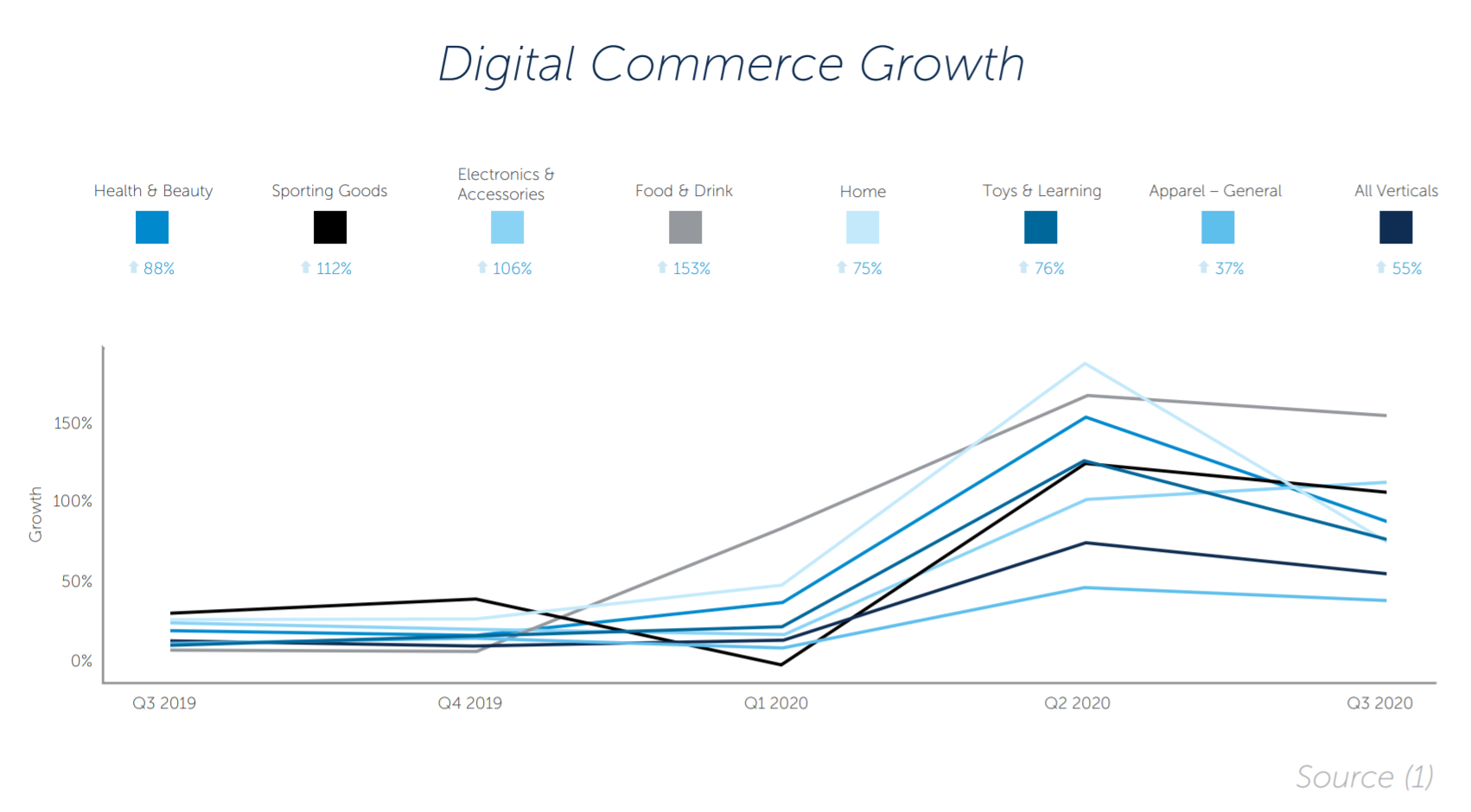

The impact of COVID-19 on consumer behavior is undeniable, as consumers shift their shopping behaviors to the digital world. As a result, more than 75% of Americans tried out new products or services since April 2020 that they want to continue using in the long term (2). This shift in consumer behavior created a never before seen increase in global digital commerce activity. The vast majority of industry verticals featured on the Salesforce Shopping Index saw digital commerce grow around 50% from Q3 2019 to Q3 2020, some surpassing 100% with ease.1 It is believed that these changes in behavior will remain prevalent after the impacts of COVID-19 have subsided due to the convenience and efficiency consumers have become accustom to experiencing. A McKinsey survey about consumer sentiments in the US confirms this prediction, reporting that about 40% of Americans see cost savings when shopping online and as much as 70% of Americans believe that COVID-19 will have a lasting impression on personal routines (3).

In just five years, from 2015 to 2019, e-commerce sales doubled its share of global retail sales from just over 7% to 14%.4 This trend is expected to continue in the years to come as not only consumers, but also retailers and manufacturers, are changing their business models. E-commerce enables a direct to consumer (D2C) model that traditional business to consumer (B2C) and business to business (B2B) companies can benefit from. While B2C companies want to deploy a D2C model to build brand loyalty, B2B merchants use it to create a B2C-like experience as they are able to cut out wholesalers and distributors.

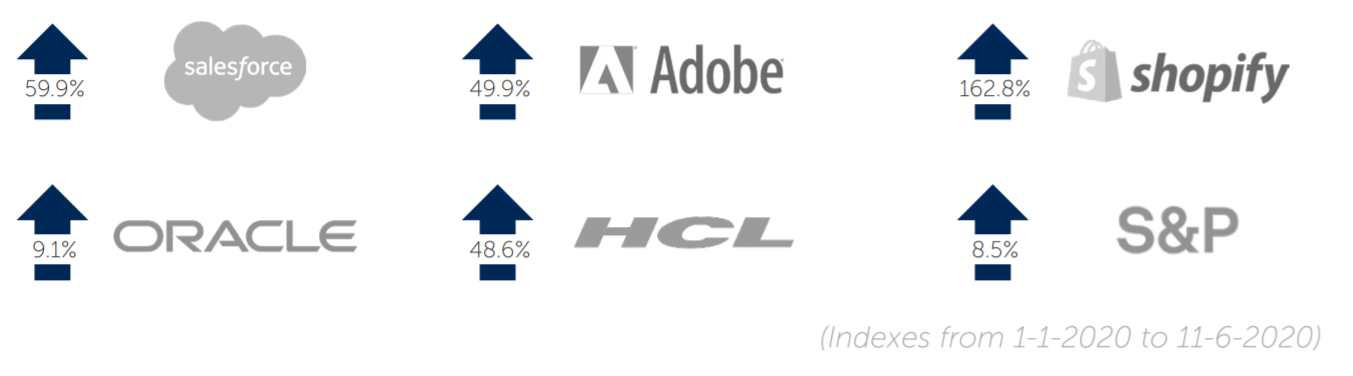

Lastly, we have observed that many publicly traded technology and digital services firms have by far outpaced the S&P 500. While the S&P 500 was still trading at 8.5% year-to-date, many technology firms were surpassing their highs from the beginning of the year. Investors, both public and private, have accepted the changes brought on by COVID-19 and have identified the companies that will outpace the overall market as a result.

Platform Overview

SAP and Oracle are geared towards the world’s largest enterprises, but today Salesforce Commerce Cloud and Adobe’s Magento, both of which were traditionally focused on SMB clients, are continually gaining momentum at the enterprise level. Salesforce Commerce Cloud – made up of its B2C solution formerly Demandware (acquired in 2016) and its B2B solution formerly Cloudcraze (acquired in 2018) – is a strong contender with an ability and reputation to take on large-scale, multi-national, and extensive product catalog e-commerce implementations. Adobe Commerce, Magento (acquired in 2018), strategically moved (after the acquisition) into the enterprise market after largely serving the SMB market since its inception. Both Salesforce and Adobe are competing to offer a complete and fully integrated CMS, CRM, marketing, commerce, and analytics platform enabling leading merchants in their respective industries to excel. As Adobe and Salesforce go after the upper mid-market and enterprise market share, Shopify is rapidly scaling and adding merchants in the SMB to mid-market space with their lower cost SaaS-based solution.

Platforms Based On Momentum

Salesforce Commerce Cloud

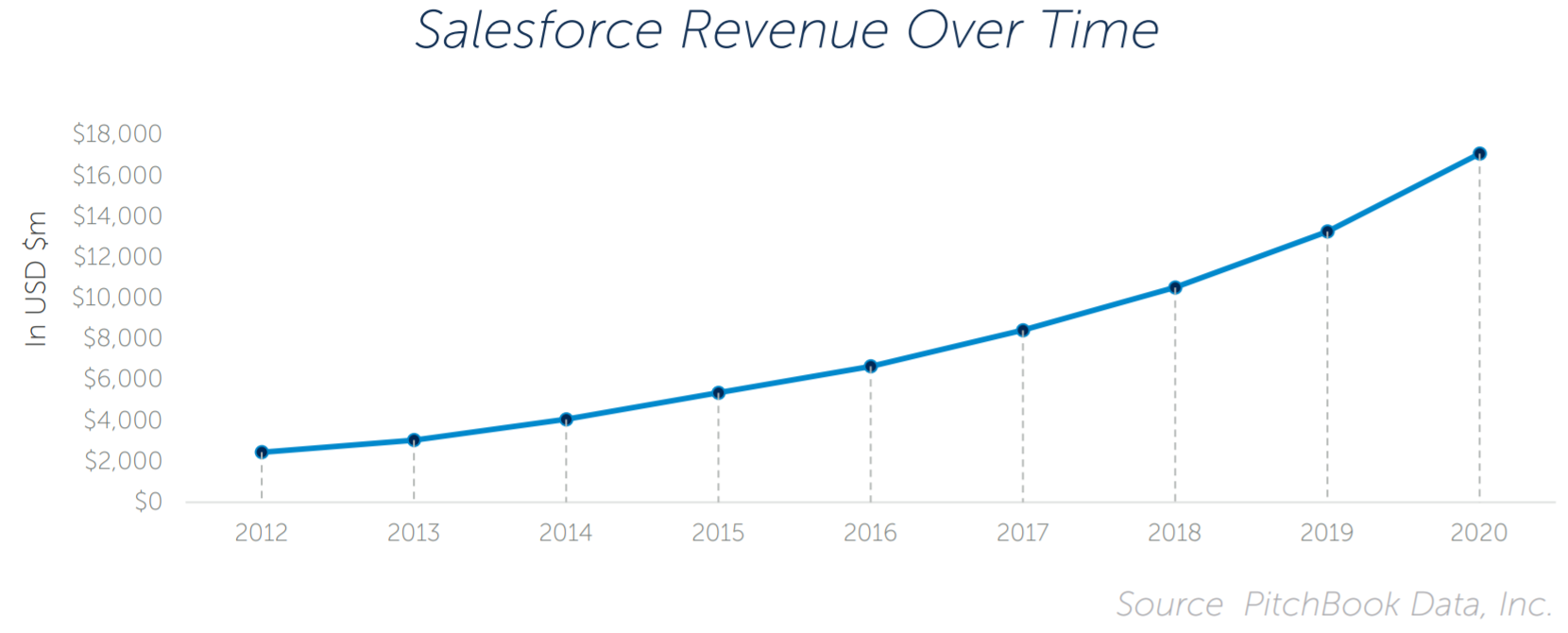

For many years, Salesforce has been recognized as one of the leading digital commerce companies in the world (4). Created in 2016 through Salesforce’s acquisition of Demandware, Commerce Cloud is a multi-tenant cloud platform that enables B2C and B2B brands to offer unified customer experiences across channels like social media, web, mobile, and physical stores. The offered B2B solutions allow merchants to seamlessly integrate activity data from their sales channels into Salesforce’s CRM offerings, enabling them to effectively

track their customers orders, carts, and opportunities. The B2C solutions have similar tracking capabilities. B2C merchants are able to unify customer engagement through one platform using Commerce Cloud’s AI, Einstein, which can aggregate customer data – whether the customer is using the web or mobile sites, social media, or email – and individualize customer interactions to drive conversion rates and brand loyalty (6). Commerce Cloud is one of Salesforce’s fastest growing business segments at 32% year-over-year to more than $2.5 billion in revenue in 2020 (7).

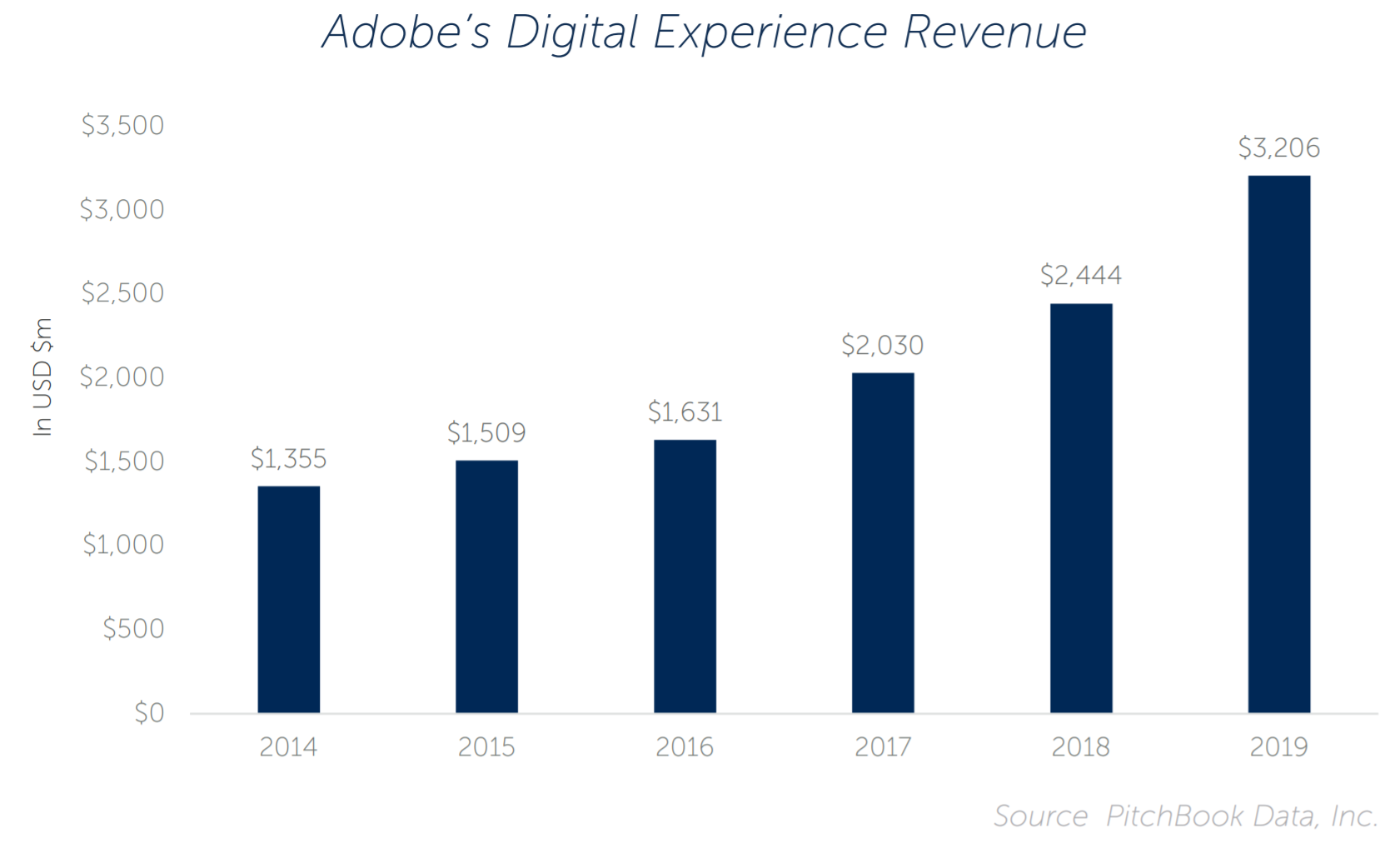

Adobe Magento

In 2019, Gartner announced Magento as a leader in digital commerce for a third consecutive year (8). Magento Commerce, which powers Adobe Commerce Cloud, is Adobe’s competitive e-commerce platform to Salesforce’s Commerce Cloud. Adobe acquired Magento in 2018 for almost $1.7 billion (9). Originally focused on the SMB market, Adobe has created an Enterprise Edition of the platform to deliver its solutions to larger companies. Adobe’s Commerce Cloud has the ability to integrate with a variety of other Adobe solutions including Adobe Analytics Cloud, Adobe Marketing Cloud, and Adobe Advertising Cloud, further driving the platform performance. These solutions enable brands to implement an end-to-end solution for their e-commerce experience, as it allows for the management, personalization, and optimization of various commerce touch points. Over the last decade, Adobe has grown its Experience Cloud business segment from an annual revenue of around $500 million in 2010, to more than $3 billion in 2020 (10).

Shopify

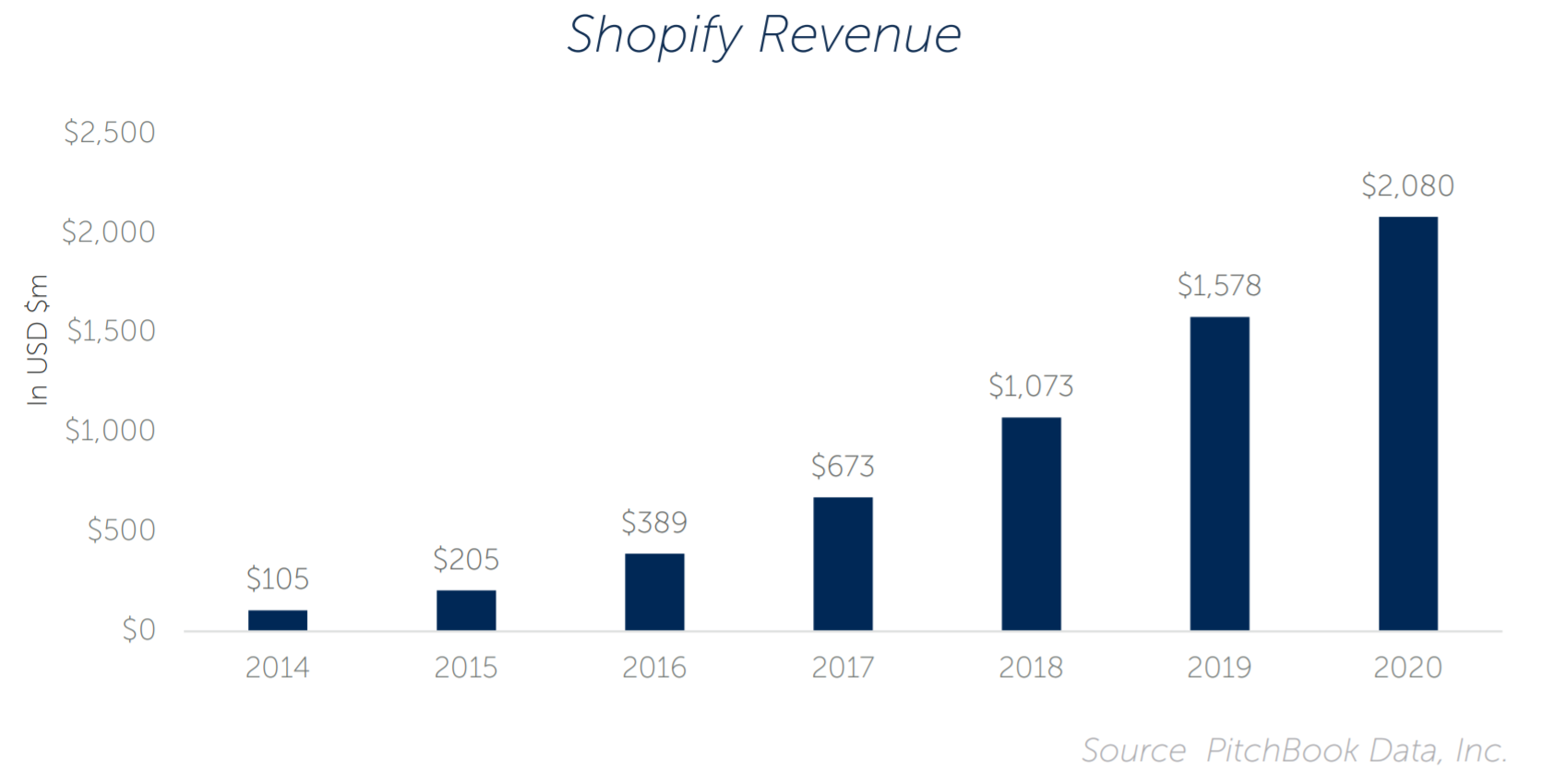

Shopify is taking the SMB marketplace by storm with a low-cost solution that can compete with platforms such as Magento and

Salesforce; however, unlike Magento and SF, Shopify offers a fully SaaS solution. Not only is Shopify in a high-growth industry with expected accelerated growth, Shopify has achieved market leading growth rates of nearly 100% YoY growth in early years and ~50% YoY growth in recent years even as they cross into doing several billion in revenue. Shopify is a top pick for investors due to their ability to deliver an affordable e-commerce platform that is accessible to SMB clients.

Elastic Path Commerce

Elastic Path is uniquely positioned to deliver solutions for one of e-commerces most prominent trends, headless commerce (see trends section). The platform is a pure-play e-commerce solution that provides comprehensive commerce capabilities for complex multi-vendor environments. Elastic Path Commerce’s strongest feature is its seamless integration with a variety of content delivery systems, including web content management (WCM), content management systems (CMS), any digital experience platforms (DXPs), and custom front-end presentation layers. This allows merchants to have an e-commerce solution that can be deployed through and connects with any kind of customerfacing technology, such as apps or social media, as well as POS devices (11).

SAP Hybris

SAP Hybris was formed through SAP’s acquisition of hybris AG. The e-commerce platform was the perfect addition to SAP’s existing products to create an end-to-end solution set for the customer journey. SAP Commerce Cloud is similar to Elastic Path Commerce in the sense that it enables the merchants to utilize a headless commerce model. Unlike Elastic Path, SAP offers a variety of other front and back end add-on tools to increase efficiencies and create a more enjoyable customer journey. Additional tools include SAP’s Customer Data Cloud, Marketing Cloud, Sales Cloud, and Service Cloud. These add-ons allow merchants to take full advantage of the SAP ecosystem to create a full cycle e-commerce platform that collects and stores customer data, analyzes it, and utilizes the newly gained insights to improve sales and customer service processes (12). Cloud revenue has been a major growth driver for SAP, as its suite of cloud products experienced 40% revenue growth in 2019 (13).

HCL Commerce

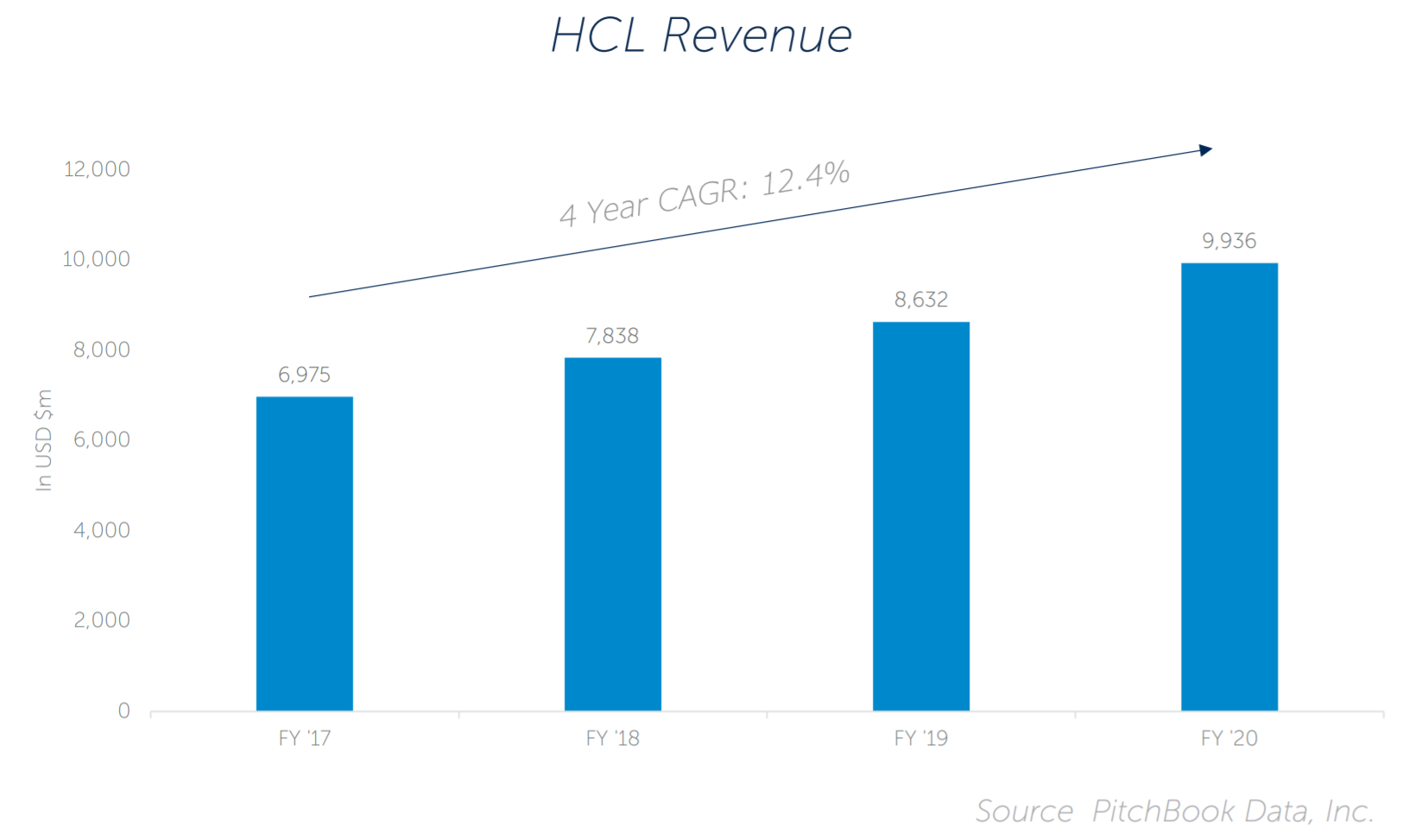

In December 2018, HCL Technologies announced its acquisition of IBM’s e-commerce platform for about $1.8 billion (14). The platform featured additional digital commerce solutions around marketing and customer experience. Earlier this year, HCL partnered with

Google to bring HCL Commerce and related software offerings to Google Cloud. The platform now allows for multi-cloud and hybrid-cloud deployments with a secure and elastic infrastructure. HCL Commerce includes a headless commerce model and various front-end customizations for B2C and B2B merchants. Additional CMS and CRM tools, coupled with Optimized Merchandising that includes natural language processing capabilities, allow for targeted customer interactions. The platform has proven itself to be very effective, as customers in the retail industry have seen a 108% increase in conversions and a 5% increase in revenue from cross-sell promotions through optimized merchandising (15).

Brands Reinventing the Consumer Experience

In recent years, many consumer brands have started to deploy mobile apps and other digital strategies to expand their presence in the digital shopping landscape. These transformations include an increased social media presence through specifically tailored content and the development of brand-specific mobile apps to drive brand loyalty and streamline customer interactions, as well as the deployment of AI in the form of chat bots and other analytical tools.

Chipotle – In 2017, Chipotle announced the release of a mobile app that is meant to bring their business to the digital realm.16 The app, available on Apple and Android devices, enables its user to quickly and comfortably order and pay for food. The app also has a feature called “Smarter Pickup Times” that allows users to choose specific pick-up times, giving them more control over the ordering process.

Dominos – First released in 2008 and re-engineered in 2019, Domino’s GPS tracker for its pizza deliveries is a similar example of a brand reinventing its customer interaction. The app allows its customers to track their orders in real time

while receiving additional information about the delivery process, such as the name of the person delivering the pizza. While being a success with customers, the app also created a data capturing tool for franchisees, as it allows them to gain valuable insights into the delivery processes and their efficiency (17).

Warby Parker – Warby Parker released a VR tool in early 2019 that allows its customer to try on glasses from the comfort of their home. The same feature has been adopted by a variety of other retailers, including IKEA, in recent years. The tools enable customers to experience a more pleasant and streamlined shopping experience, as order and payment options are available though the app as well (18).

Trends Driving Growth For Technology & Digital Consultancies

E-commerce has seen rapid innovation in recent years that is bound to continue, as consumers are getting acclimated to the use of online mediums to buy essential as well as non-essential goods. Currently, there are a number of trends, including headless commerce, direct to-consumer (DTC), progressive web apps, and personalized customer interaction, that are driving growth in the industry.

Headless commerce enables merchant’s to decouple front and back end operations of their e-commerce strategy. The front end part of the operations include the presentation side that includes social media and other online presences like web stores, while the back end operations refer to the e-commerce solution or platform that is integrated to manage commerce functionality. Headless commerce is especially useful for merchants that are content driven and in the need of lowering customer acquisition costs (CAC). The seamless integration of various AI and AR technologies on the front end enables brands to personalize and improve customer engagement, while ultimately driving conversion rates and lowering CAC (19).

Direct-to-consumer is a form of commerce that was given way by the acceleration of digital commerce. The D2C model enables manufacturers to cut out wholesalers, distributors, and retailers, ultimately saving costs and lowering costs for consumers. This also means that things like logistics, marketing and customer service become the merchants responsibility. Shopify is one of the most popular e-commerce platforms that provides a D2C model. A well known brand that utilizes a D2C model is the Dollar Shave Club. Dollar Shave Club provides shaving products through its website at lower cost than comparable retailers (20).

Progressive web apps, originally introduced by Google engineers in 2015 (21), have been adopted at high rates in recent years. The term refers to websites that utilize the latest web technology, but are designed to look and feel like mobile apps. This enables users to comfortably access websites from mobile device browsers in a mobile friendly web environment without having to download any apps. Progressive power apps have been proven to increase website performance by increasing visitor traffic, conversion rates, and engagement time, while lowering loading times and bounce rates (22). Prominent examples of companies that have adopted progressive web apps are Forbes, AliExpress, Twitter, and Pinterest (23).

Lastly, merchants are deploying various technologies to customize and personalize while automating various steps of their customer engagement. To achieve this, many companies deploy AI and machine learning technologies to track and collect data on user behavior, analyze the data, and customize their customer communication based on the insights gained. Not only do brands strive to deliver personalized communication, but almost 75% of customers are expecting brands to understand their needs and adapt accordingly (24). For this purpose, many deploy chat bots with natural language processing (NPL) capabilities to combine automation and customization in the customer service process.

M&A Activity

M&A activity in the digital commerce market has been strong in recent years. Salesforce Commerce Cloud currently does not have a lot of service providers, but the fact that they are rapidly growing is driving interest from strategics and financial investors alike. Magento, by being pulled into the Adobe Cloud ecosystem, is now part of a more inclusive set of solutions for enterprises, which drives interest in Magento partners. Lastly, investor’s interest in Shopify is mainly driven by its massive growth in market share, while demonstrating its ability to add websites to its platform.

7MA E-commerce Transactions

- Zilker Technology acquired by EY (Sellside Advisory)

- Something Digital acquired by Genpact (Sellside Advisory)

- Keste acquired by Trinity Hunt Partners (Sellside Advisory)

- Springbox acquired by Prophet (Sellside Advisory)