Overview

The Canadian IT Services market is rapidly changing and continually growing more attractive to global IT Service providers. Canada is becoming a viable alternative for large Offshore IT Services companies who previously delivered out of India, Eastern Europe, and Latin America, for US-based enterprise clients. We are seeing the shift to Canada for a variety of reasons including: the convenience of near-shore delivery, English fluency, strong local technology talent, competitive bill rates in areas like Calgary and Edmonton due to low cost of living and an attractive foreign exchange rate, and recently increased H-1B Visa rejection rates in the US. For these reasons 7 Mile Advisors is seeing additional M&A activity and organic expansion across Canada.

H-1B Visa Implications

Increasing H-1B Visa rejection rates in the U.S. are encouraging international IT firms to look at Canada as a potential nearshoring solution for skills and talent. H-1B rejection rates are approaching 40% for several top Indian IT firms under the Trump administration, greatly impacting firms like Cognizant, Tech Mahindra, and Tata Consultancy Services among others [1]. These firms are having to grapple with how best to cater to US clients in order to win business. While recruiting and training US talent is one option, acquiring nearshore existing talent – such as Canadian firms – present an additional opportunity to address the talent gap at the middle and senior levels. 7 Mile is seeing firms turn to M&A in order to achieve scale quickly – see M&A activity below. Pursuing the right M&A opportunities represents a strong option as H-1B affected firms can grow both in the desired digital space and from a strategic location perspective.

Select Firms Impacted:

Western Canada IT Services

Companies see the area as a growth market for technology and digital transformation services.

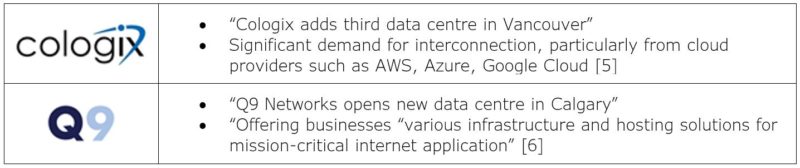

Recent investments in the region highlight growth expectations

Growth in supporting technology services often go hand-in-hand with these expansions

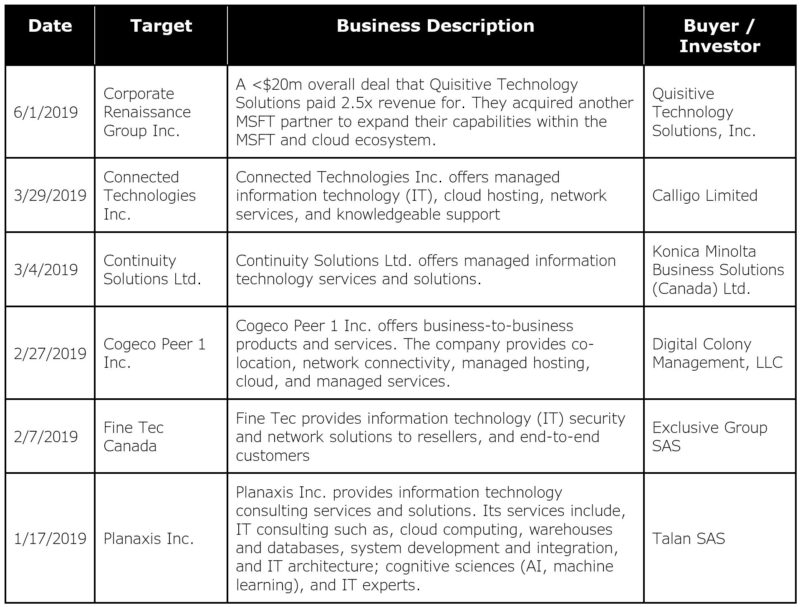

Canadian Tech M&A Market

Strong Canadian and global economic conditions have spurred activity in the country’s M&A market. While technology companies have often led in disruptive M&A transactions, non-tech acquirers have become the largest acquirer group. A similar trend is present among financial buyers — “U.S. buyout specialist KKR & Co. is actively making the rounds of tech hubs in Toronto, Waterloo and Vancouver, in the hopes of scoring the first Canadian investment for its Next Generation Technology Fund.” [7]

Below is a selection of recent technology related M&A transactions where Canadian companies were the target:

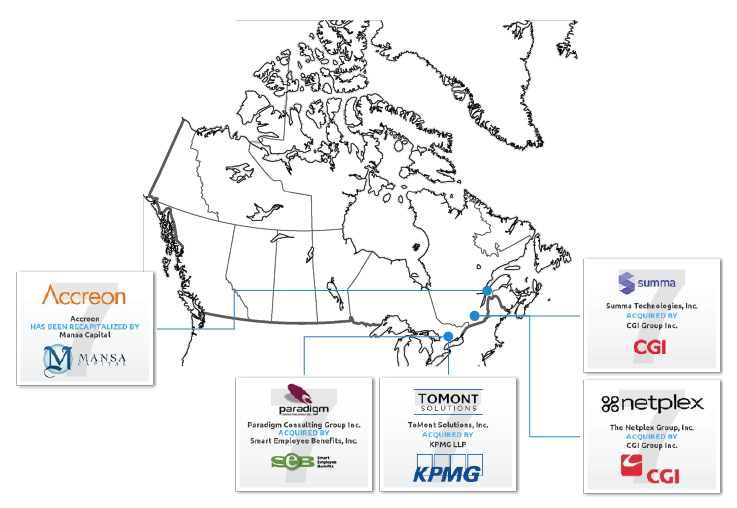

7MA Deals in Canada:

Sources:

- [1] H-1B Visas

- [2] Cisco Press Release

- [3] KPMG Ignition Center

- [4] Garmin moves into alberta

- [5] Cologix

- [6] Q9

- [7] Deloitte