The Monthly Claim – November 2021

Industry Updates

The best articles from around the web for Insurance industry leaders

Industry Trends: Liberty Mutual is Moving its 2,200 Exclusive Agents to its New Digital Agency via Insurance Journal:

Liberty Mutual Insurance, the nation’s sixth-largest personal lines property/casualty insurer, is planning to transition its more than 2,200 exclusive insurance agents in 200 offices across the country to working for a new agency it is starting.

The global insurer is launching a digital agency called Comparion, which will offer auto, home, and small commercial insurance options from Liberty Mutual and more than 50 other national and regional carriers.

In addition to its exclusive agents who are soon to become Comparion agents, Liberty Mutual also distributes its Safeco Insurance personal auto, homeowners, and specialty products, and Liberty Mutual small business insurance through more than 10,000 independent agencies countrywide. It will gain a network of approximately 3,400 additional independent agencies across 33 states when its pending acquisition of State Auto Group closes.

Market Moves: AIG Profit Beats Wall St Estimates on General Insurance Boost via Reuters:

American International Group Inc (AIG.N) exceeded market estimates for quarterly profit as its general insurance business faced fewer natural catastrophe and COVID-19 pandemic-related claims.

The company’s general insurance accident year combined ratio – which excludes catastrophe losses – was 90.5 for the quarter, compared with 93.3 a year earlier. A ratio below 100 means the insurer earns more in premiums than it pays out in claims.

AIG’s life and retirement unit posted a 13% fall in adjusted pre-tax income to $877 million. The company said the planned initial public offering of the unit, in which Blackstone Group (BX.N) has bought a sizeable stake, was on track for 2022.

Industry Trends: Where InsurTech and Human Interaction Meet via Property Casualty 360:

Over the past decade, we have seen the Insurance industry gradually increase its adoption of new digital technology to better meet the instant online needs of consumers who, like with any other industry, are demanding speed, convenience, and transparency when it comes to working with their insurer. For the Insurance industry, having technology that can scale and update with these changing demands can help insurers stay ahead of the competition.

Some examples of InsurTech applications are machine learning (ML), artificial intelligence (AI), blockchain, and the Internet of Things (or IoT). These applications offer capabilities and solutions that are more commonly applied in and associated with online insurance applications, quotes and policy management, chatbots, claims reporting, and payment processing — to name just a few.

Without understanding the holistic nature of InsurTech and its various applications, it’s no wonder that some companies continue to view the entire process as competing with or even replacing human intelligence. The reality is many applications are designed to work in tandem with humans, helping save valuable processing time in areas such as assessing accidents, identifying discrepancies in billing, and allowing consumers to view and manage policies and billing anomalies online.

Market Update: AXA’s Investment Arm to Divest Oil and Gas Climate Laggards After Three Years via Insurance Journal:

The fund arm of French insurer AXA said it would take a tougher line with oil and gas companies over their environmental impact, selling out of laggards after three years if their emissions-reduction plans were not good enough.

As part of an overhaul of its sector investment policy announced at the COP26 climate talks in Scotland, AXA Investment Managers also introduced a set of new exclusions “to mitigate the adverse impacts of the industry on the environment.”

AXA and its peers have undertaken net-zero carbon emissions across their portfolios, with big cuts needed by 2030 in order to meet mid-century targets. Beginning in early 2022, AXA IM said it would exclude any company for which oil sands represent more than 5% of total production, down from a previous 20% threshold.

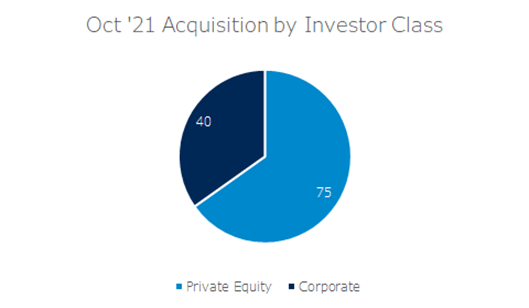

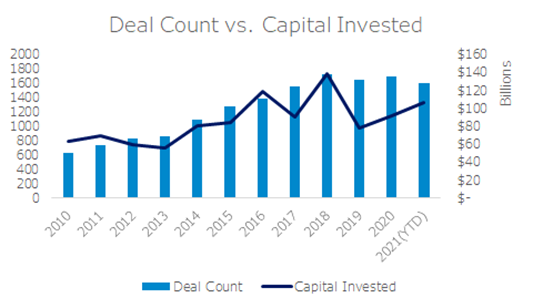

Market Data: Insurance Tech Q3 2021 Report via CB INGISHTS:

Although global InsurTech funding has dropped 35% from the previous quarter’s record peak to $3.1b across 113 deals, InsurTechs have raised a whopping $10.5b across 427 deals in 2021 so far. This funding figure is already 48% greater than 2020’s year-end total, and deals are also up 13%.

Q3 2021 represents another strong quarter for InsurTech. Mega-round count remained elevated at 11, while early-stage deal sizes saw a 90% quarter-over-quarter (QoQ) increase. And as cybersecurity continues to be a major challenge for businesses of all sizes, 2 of the top 3 largest deals this quarter went to startups building cyber insurance and risk management solutions.

M&A Outlook

Insights and intelligence on recent notable industry transactions.

Notable Property & Casualty Transactions

Concirrus Acquires Spark Insights via Reinsurance News:

InsurTech firm Concirrus has completed its acquisition of Spark Insights, a provider of decision analytics to the Insurance market.

Spark Insights was founded in 2018 by InsurTech expert Ira Scharf with the aim of using AI, machine learning, and computer vision combined with satellite-based remote sensing and global earth observations to provide insurance insights.

Concirrus was founded on a passion to harness the IoT and vast datasets to uncover insights that could create a more sustainable future for commercial insurance. Specifically built for commercial insurance by leading insurance practitioners and technologists, its suite of AI analytics and digital capabilities are empowering the market.

Verisk Acquires Driver Data Company via Verisk:

Verisk (Nasdaq:VRSK), a leading global data analytics provider, has acquired Data Driven Safety, a leading public record data aggregation firm that specializes in driver risk assessment in the United States. The acquisition will expand Verisk’s robust auto insurance analytics, providing insurers with information to further refine underwriting, improve the customer experience, and promote public safety.

Data Driven Safety, with its unique data collection and management platform, gathers information on traffic citations, vehicle accidents, and driving records from public sources.

“Adding billions of driver risk records improves the granularity of our innovative risk-indicator solutions and will help customers advance their digital transformation strategies,” said Doug Caccese, President of ISO Personal Lines at Verisk. “Verisk will be able to provide insurers with a more complete and cost-effective view of auto risk while enabling them to tailor the purchase experience and reward customers that have a history of safe driving practices.”

Lemonade to Acquire Metromile via Yahoo Finance:

Lemonade (NYSE: LMND) the insurance company powered by AI and social good, and Metromile (NASDAQ: MILE, MILEW), the data science company focused on auto insurance, have entered into a definitive agreement pursuant to which Lemonade will acquire Metromile in an all-stock transaction that implies a fully diluted equity value of approximately $500 million, or just over $200 million net of cash.

While Lemonade has been at the forefront of using big data and AI in home and pet insurance, Metromile has been trailblazing a parallel path for car insurance. Metromile’s car-mounted precision sensors took over 400 million road trips in recent years, covering billions of miles and sending real-time streams to the Metromile cloud. These were cross referenced with actual claims data, yielding precise predictions for losses per mile driven. These algorithms hold the promise of propelling Lemonade Car from a newcomer in the car insurance space to its vanguard.

The acquisition will help Lemonade reduce the time to process claims, price more accurately, flatten risk, and increase operational efficiencies.

About 7 Mile Advisors

7MA provides specialized Investment Banking & Advisory Services to the professional service firms in the Consumer Products & Retail industries. We help our clients determine the right strategic partners for their businesses, transition ownership, raise capital, grow through acquisitions, and evaluate new markets. We advise our clients on M&A and private capital transactions, and provide unique market insights. Our team brings experience and energy to all of our engagements, with a focus on helping our clients navigate a changing marketplace.

To learn more about how 7 Mile Advisors can help you evaluate and execute on strategic M&A or private capital alternatives for your business, please visit our website www.7mileadvisors.com.