Part I: Overview

Value-Added Resellers (VARs) have been around for decades, originally emerging out of a demand for rapid deployment of physical IT equipment. These original VARs served solely as the external distribution channel, or sales arm, for hardware focused technology manufacturers and added value by customizing and bundling OEM equipment to meet technology needs for enterprise clients. Today, VARs still fulfill a straightforward, but critical, need for enterprise clients – serving as trusted advisors in regards to all things IT equipment related; including roadmapping, building and architecting customized solutions that may now involve public cloud components.

VARs are truly value-add because they enable client’s internal IT teams to focus more closely on business operations, while the strategic aspects of IT can be offloaded to a technology partner. In today’s evolving IT landscape, VARs still live by the same value proposition. With the advancements in cloud technology, and the overall shift from maintaining an on-premise data center to cloud environments, VARs find themselves in a critical position to help clients navigate hybrid environments, cybersecurity, hyper-converged infrastructure, IT support, and data management. Not only have they shifted their traditional value added reselling and solutions capabilities, they are also providing managed services to ensure the effective use of IT equipment in an ongoing manner.

In this blog we focus on the impact of public cloud to the VAR community.

Varying Cloud Environments

Over the past decade cloud computing has emerged as an increasingly important offering from the largest tech companies. Microsoft defines ‘the cloud’ as a blanket term describing a vast global network of servers providing computing power, each with a unique function, but to the eyes of the end user, operating as a non-physical environment that can be tapped into and scaled up or down according to the needs of the user. Enterprises utilize the cloud to store and manage data, run applications, and deliver online content…“Instead of accessing files and data from a local or personal computer, you are accessing them online from any Internet-capable device—the information will be available anywhere you go and anytime you need it.” [1] Typically the cloud refers to the public cloud, but within cloud-computing there is optionality that exists in how specific environments are delivered, which is important to distinguish.

There are three basic cloud environments [2]:

- Public Cloud

- Private Cloud

- Hybrid Cloud

These are the three primary environments, but they can also be broken into on-premise or off-premise cloud environments.

Public Cloud

The public cloud environment is the most common deployment, and is essentially turnkey. Servers and storages are owned and operated by a third-party cloud service provider and delivered over the internet.

Leaders in public cloud include:

Advantages:

- Low upfront costs – shifting capex expenses to opex in a recurring manner diminishes the one-time investment needed for IT hardware and IT software. Typically, this is paid for by consumption (i.e. pay for only that which you use).

- No maintenance—your service provider provides the maintenance

- Near-unlimited scalability—on-demand resources are available to meet your business needs

- High reliability—a vast network of servers ensures against failure

Private Cloud

In response to demands for ultra-secure, privacy of data environments, these same public cloud vendors offer Private Cloud as a way to provide comfort to organizations in highly regulated industries, or industries for which information security needs to be highly secure (i.e. financial institutions and healthcare). When it comes to the private cloud, organizations can choose on-premise or third-party hosting, assuming they have the technical resources and staff to manage an on-premise environment. Services and infrastructure are always maintained on a private network making this optimal for enterprises seeking security.

Advantages:

- Flexibility—organizations can customize cloud environments to meet specific needs

- Security—infrastructure resources are not shared like in public cloud environments enabling higher security

- Scalability—private clouds still provide scalability and efficiency similar to public cloud environments [2]

Hybrid Cloud

The Hybrid Cloud is an environment that is rapidly gaining popularity for its flexibility. This solution allows enterprises to utilize the benefits of the public cloud scalability, while maintaining the security benefits of a private cloud for certains aspects of business – maximizing the benefits of a cloud environment. In this environment, an organization can choose to run high-volume, low-security needs like web-based email in the public cloud while running financial reporting in an on-premise private cloud. There is also something called “burst through”, providing enterprises the option to utilize the public cloud only as a backup in times of high activity (i.e. around the holidays for a retailer)

Advantages:

- Control— maintain private infrastructure for sensitive assets.

- Flexibility— take advantage of additional resources in the public cloud when needed.

- Cost-effectiveness—with the ability to scale to the public cloud, only pay for extra computing power when needed.

- Ease— cloud transitions are not overwhelming because migrations can gradually take place—phasing in workloads over time. [2]

What Does this Mean for VARs?

You might be asking how VARs fit into this evolving landscape. Although public cloud is highly buzz-worthy and accounting for an increased percentage of IT spend, there is a newly emerging trend of enterprises seeking hybrid environments – presenting a huge business opportunity for hardware and IT consulting services providers to deliver hybrid cloud specialities.

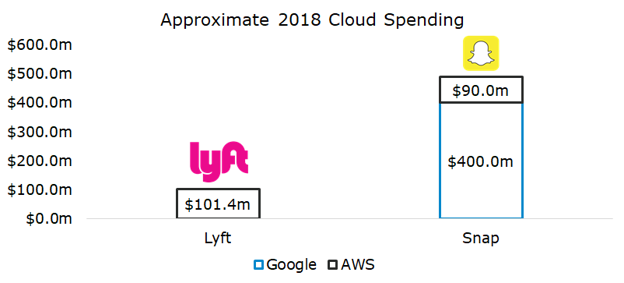

Take two recent IPOs as an example of why this is the case: Lyft and Snap, both announcing IPO’s within the last two years. Upon the release of these two S-1’s, investors were astonished, and troubled, at the cost each of these organizations are paying to Google and AWS for cloud consumption. Reference the below for an estimation of cloud spending.

Data Source: [3], [4], [5]

According to multiple sources, and Lyft and Snap’s filings during their initial public offerings, these two disruptors are paying a steep price to operate in a public cloud environment. Lyft has committed to spending around $300m to AWS for cloud-computing through 2021, or $100M annually, and Snap has committed to paying Google upwards of $2b over five years and AWS another $1b on top of that [3][4]. Both Lyft and Snap signed contractual obligations to pay the above amounts as the minimum payment, but have the option to spend more based on usage. If usage doesn’t meet the minimum obligation, both Lyft and Snap are forced to make up the difference.

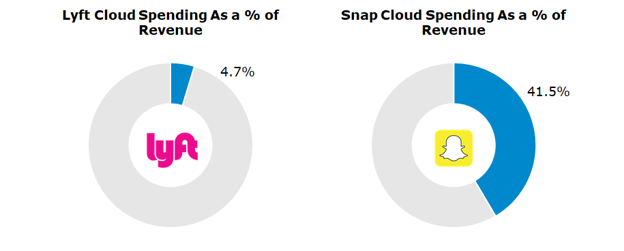

Data Source: [3], [4], [5]

As a percentage of revenue, Lyft is spending ~5% on cloud-computing while Snap is spending ~42% – one of the primary reasons Snap’s 2018 EBITDA margin is -97.1% [3][5]. To expect all enterprises to risk spending almost 50% of their revenue on cloud expenses is completely unrealistic. Not to mention Snap’s contractual agreement with AWS consists of an escalating minimum obligation schedule over the next five years.

Conclusion

On one side, going through third-party cloud providers enables businesses to rapidly scale. On the other, businesses that are not doubling revenue growth year-over-year on a multi-year basis, like Lyft, can be absolutely overtaken by cloud-computing costs. Even for companies that are scaling rapidly, enterprises are finding that the hybrid cloud environment is optimal to minimize costs while obtaining the capabilities of a public cloud environment when needed. The public cloud enables businesses to do things never before possible, but in the end comes at a costly price tag that isn’t necessary in some cases. We anticipate that organizations will need to seek out specialists in the hybrid cloud environment to find a happy middle ground, therefore VARs experienced in both the physical hardware components necessary in an on-premise environment as well as the technical capabilities associated with a cloud environment are positioned for substantial growth over the next several years.

Part II: M&A Activity and VAR Benchmarking

M&A Activity

The hybrid cloud environment is one driver of near-term growth for the VAR industry. Beyond that, many VARs are incorporating inorganic growth by way of acquisitions to seek increased operating leverage through scale. Some primary valuation drivers for VARs, among others, include:

1) Gross Margins exceeding 25%+ – typically indicative of a strong services component

2) Strong Revenue growth of 10 – 15%+ – signalling competitive differentiation and market demand

3) Scaling Managed Services offerings – providing for long-term revenue visibility

4) Cloud strategy – vision and strategy in the evolving IT landscape that incorporates the impact of public cloud and hybrid cloud environments

Benchmarking

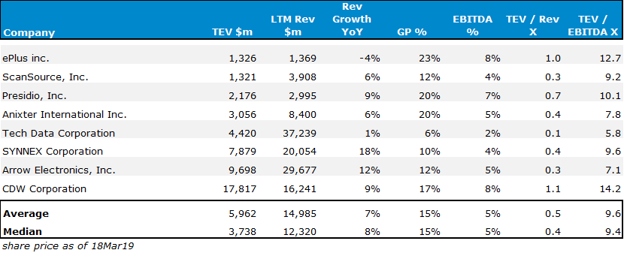

The table depicted below shows financial metrics for some industry leading VARs.

Public Comparables

Data Source: CapIQ

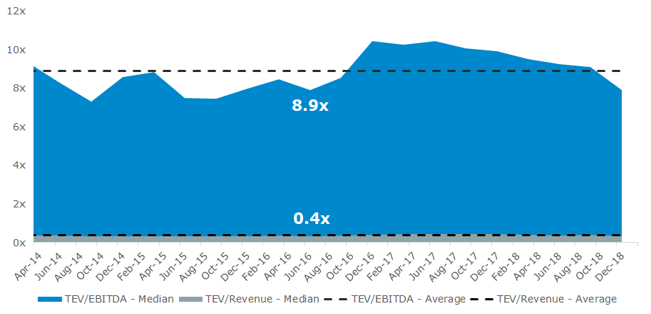

The graphic depicted below shows public trading multiples for the same industry leading VARs.

Public Trading Multiples

Data Source: CapIQ

Recent 7 Mile Transactions

- SADA Sytems Microsoft Services Business acquired by Core BTS, a Tailwind Capital Portfolio Company [details]

- Mainline Information Systems has acquired RTP Technology Corporation [details]

- Netserve 365 acquired by Magna5 [details]

- MBI Solutions acquired by ESW Capital [details]

- ToMont Solutions acquired by KPMG [details]

Footnotes:

[2] What are public, private, and hybrid clouds?

[3] CapIQ

[4] Lyft has to pay Amazon’s cloud at least $8 million a month until the end of 2021

[5] Snap will pay Google at least $400 million a year for the next 5 years

About 7 Mile Advisors

7 Mile Advisors provides Investment Banking & Advisory Services to the Business Services & Technology Industries globally. 7 Mile Advisors advises on M&A and private capital transactions, and provides market assessments and benchmarking. As a close-knit team with a long history together and a laser focus on our target markets, 7 Mile Advisors helps its clients sell companies, raise capital, grow through acquisitions, and evaluate new markets. For more information, including research on the M&A markets, visit www.7mileadvisors.com.

All securities transactions are executed by 7M Securities, LLC, member SIPC/FINRA.